Disability Benefits Canada: Protecting Your Ability to Earn a Steady Income

- 04/15/2024

Ask yourself: What’s your most valuable asset? Some might say their home, others a piece of fine jewellery or a dream sportscar. While these possessions undoubtedly have value, if you’re not independently wealthy, your most valuable asset is your ability to earn an income to cover life’s expenses.

Consider this: in the event of a significant injury or illness your physical assets can be sold to generate short-term cash, but without the security of disability insurance, you risk losing not only your livelihood, but also compromising your family’s financial security.

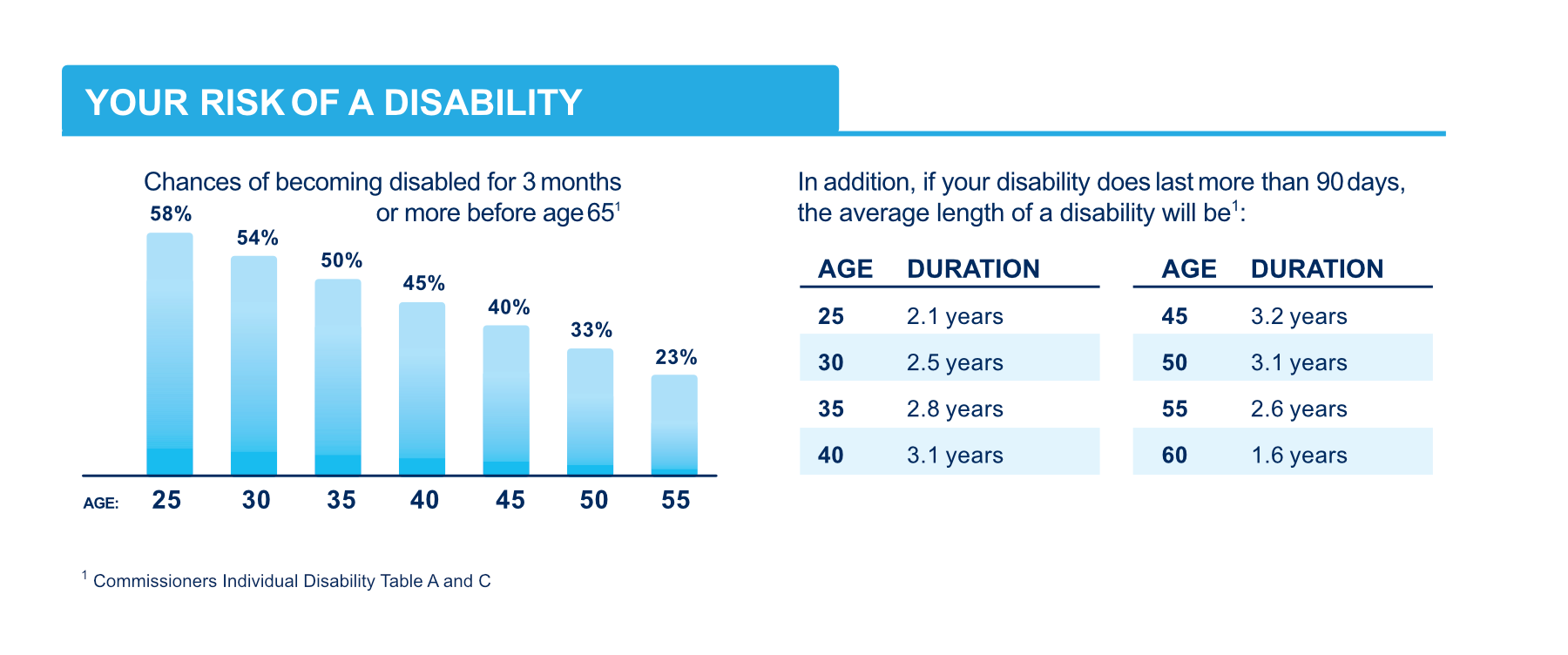

Still, while we all carry insurance to protect our homes, possessions and vehicles, many Canadians neglect to purchase disability insurance to protect that financial security. What’s more, when thinking about disabilities, many of those same Canadians underestimate the odds of being personally affected by a disability, or how long an injury or illness may affect their ability to return to work.

Statistics, however, show that many injuries can take longer than a few months to heal. In fact, 33% of Canadians who experience a disability that lasts longer than 90 days, will, on average, experience a duration of 37 months. In some cases, a disability can even impact the remainder of a person’s life.

For people who work for larger companies that typically provide disability benefits in their group benefits, the financial risks mentioned above are slightly lower. However, government research shows that nearly 68% of Canada’s private labour force (over 8 million Canadians) is employed by small companies which often don’t provide employees a comprehensive benefit plan. For this demographic, the potential risks are real and could be life-altering.

What conditions quality for disability benefits in Canada?

As mentioned, some workplace insurance plans provide disability benefits, and Worker’s Compensation (WCB / WSIB) may pay up to 85% of your take-home salary, but that’s only if you’re injured on the job, and still may not be enough to make ends meet. If an accident were to happen off-hours, such as a broken ankle or a rotator cuff injury, your WCB benefits wouldn’t cover you. Private disability insurance plans can provide 24-hour coverage, 365 days per year, so your income will be replaced or supplemented no matter where or when the injury occurs.

Some private plans also offer non-occupational coverage, allowing you an affordable option for ensuring your income remains protected from accidents that take place outside of work. This way, those with WCB only coverage can protect themselves outside of work. What’s more, private plans also offer income protection for Illness-related disabilities like cancer, heart attacks and strokes.

As an example, a small business owner (and Edge Benefits policy holder) tore a tendon playing volleyball on the weekend. After a period of partial and total disability, she returned to work only to be diagnosed with breast cancer days later, requiring an additional extended period away from work. Thanks to her foresight in obtaining a disability policy (income replacement insurance), she was able to maintain a source of income throughout her multiple successive disabilities and receive compensation to cover physiotherapy and other treatment costs to expedite her recovery.

In addition, her comprehensive policy covered her for both the initial injury—the torn tendon—and subsequent illness – the cancer diagnosis.

(It’s important here to understand that while injuries typically relate to fractures, sprains and strains, some injuries, such as Bursitis, Carpal Tunnel Syndrome or a Rotator Cuff injury, may become classified as an illness if their impact and treatment is prolonged over time, such as the recovery time after corrective surgery to repair the injury. When purchasing disability benefits, be sure to read policy booklets carefully and speak with a licensed advisor to ensure you understand how various accidents and injuries would be classified under the plan you choose.)

What is disability insurance?

As the above scenario helps illustrate, a disability insurance policy provides continued monthly income when an injury or medical condition prevents you from working. Depending on the benefit amount purchased, this monthly payment allows the insured person to focus on their recovery without the added stress of wondering how they’re going to pay their bills, and without having to dip into their savings or investments. Another bonus? While it can take years to build up your own personal safety net, disability insurance requires only a moderate and predictable monthly payment, and the full benefit amount becomes payable immediately after your policy’s elimination period concludes.

Beyond providing the ability to manage day-to-day living expenses, some disability insurance policies may also include an Accident Medical Treatment Benefit. This type of benefit can help offset short-term medical costs, such as physiotherapy, and other forms of rehabilitation, and even home alterations to accommodate an ongoing physical disability.

How does disability insurance work?

The mechanics of disability insurance are reasonably simple, but there are a few factors you’ll need to consider. These include:

- Benefit amount

- You’ll need to keep in mind that insurance doesn’t replace 100% of your earnings. Rather, the maximum benefit amount you can purchase is determined by an industry-wide formula that calculates your Qualifying Insurable Monthly Earnings (QIME). If you are self-employed, The Edge Benefits can calculate your benefits based on net earned income or the gross revenue from your business.

- Elimination period

- Your policy’s elimination period outlines the amount of time that needs to pass between becoming disabled and receiving your first disability benefit payment. The longer the elimination period, the lower the premiums.

- Benefit period

- Your plan’s benefit period defines the number of years your disability benefits will be payable. Short-term disability benefit periods may have lower monthly premiums, but leave you exposed to financial risk if your injury or illness becomes long-term or permanent.

- Canadian residency status

- To purchase Canadian disability benefits, you need to be a Canadian citizen, resident of Canada, or hold a valid work permit. Non-residents with a work permit are typically restricted to a shorter benefit period until their residency becomes more permanent.

- Occupational risk

- Your eligibility, maximum benefit amount, and types of coverage available to you are determined by the level of risk associated with your occupation. If you’re an office worker, for example, or a roofer, your eligibility and premiums will reflect that. If you work in a high-risk occupation, such as logging or mining, you may not be able to purchase 24-hour protection but could still be eligible for non-occupational coverage.

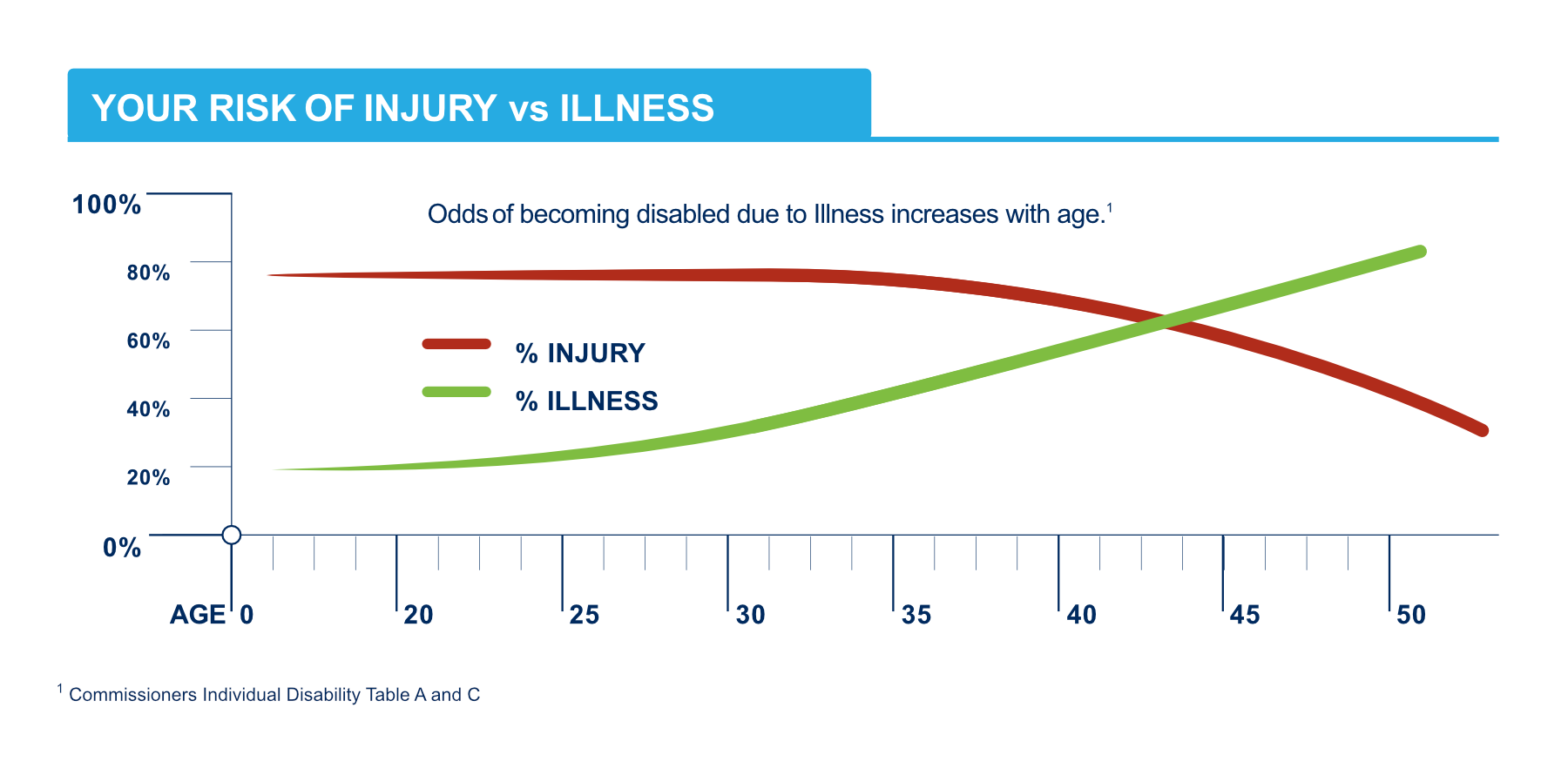

- Injury vs. Illness coverage

- Most providers offer disability insurance plans that cover injuries and illnesses under one policy. A few providers offer the option to choose a policy that covers either “injury only”, or “injury and illness”. As some professions may only qualify for injury coverage, it’s important to talk to a licensed insurance agent to understand which coverage is best suited for you.

- Certain injuries may be considered an illness

- As touched upon above, some injuries might be considered an illness when it comes to a possible payout from a disability policy. Strains, for example, or accidental injuries that need surgery may fall under this category.

- Can you work while on disability in Canada?

- Another factor to keep in mind when thinking about disability policies, is whether an insured person finds themselves with a partial disability or total disability. A partial disability means the insured person may still be able to work some of the time while receiving disability benefits, whereas a total disability means they can no longer maintain their employment.

- Own occupation vs. reasonable occupation

- Certain policies may or may not pay out if the insured person is able to acquire and maintain a job outside of their regular field (their own occupation) that will see them earn an income equal to 80% of their qualifiable monthly earnings—a reasonable occupation.

Who needs income replacement insurance?

The short answer is anyone who relies on income to pay for their lifestyle. Ironically, while younger people may feel the least at risk due to their health or age, they’re the demographic who might benefit the most from disability insurance for injuries.

Younger people have a longer stretch of bills, rent, or mortgage payments ahead of them. They’re also more likely to be working higher-risk manual jobs such as those in construction or agriculture, where a severe injury could greatly impact their ability to maintain their lifestyle or even alter their career-long earning potential. Then, when you factor in that at any given time, 20% of the Canadian population is affected by a disability impacting their daily activities, as well as the fact that your risk of being disabled due to an illness increases as you age, it stands to reason that anyone concerned about maintaining family income should have such a policy in place to be prepared for the unexpected.

While Canada’s government-sponsored disability benefits such as Canada Pension Plan (CPP) may cover some expenses in the event a Canadian becomes disabled, the government has strict rules about who can access these benefits. The government also requires that any disability must be “severe” and “prolonged” and prevent you from all types of work.

An EDGE disability plan makes it easy to find coverage that fits.

The good news? No matter what your occupation is, The Edge Benefits has an appropriate and affordable plan to keep you protected. EDGE has also streamlined the application process by simplifying the qualification criteria and removing many of the barriers still present in other carriers’ plans.

How? By creating a revolutionary offering that separates injury and illness risks, so you can design a plan that truly fits your needs and be protected by the guaranteed-issue injury coverage almost immediately. EDGE also offers an electronic application process that’s easy to use and lets you know right away if you qualify. For injury-only disability coverage, the entire process from application to policy issue can take as little as a few days—simple.

For plans that include illness, the underwriting process is simplified and fast-tracked. Based on your responses to a brief list of questions about your medical history, certain medical conditions may be excluded, but you still get a fast approval and the rate you’ve been quoted won’t change based on your medical history, guaranteed.

In addition to simplifying and expediting the application process, The Edge Benefits also closely follows emerging trends in health and disability insurance to ensure coverage adapts with the evolving needs of working Canadians. EDGE even offers affordable long-term riders (optional) that would provide a $300K tax-free lump sum payout if you are still totally disabled 60 months after starting your disability benefit payments.

Protect your financial security for the price of a latte.

What’s more, EDGE’s disability benefits are customizable and affordable. Consider that if you saved 5% of your income for 10 years, your entire safety net could be wiped out after only 6 months of income loss. For the price of a coffee per day, you could purchase a disability insurance policy that ensures no matter what happens, you and your family are covered, safe and secured by the full monthly benefit amount without having to deplete any savings.

Even better? With EDGE your plan can grow alongside you as your personal circumstances change and your income grows. We’d say that’s worth a latte or two.