What is Critical Illness Insurance, and is CI Insurance Worth it?

- 11/12/2024

What is a Critical Illness?

Although there is no universal definition of ‘critical illness’, it can loosely be defined as a severe health condition that can have a significant impact on a person’s life and may require intensive medical treatment. Some critical illnesses can lead to long-term disability or even premature death.

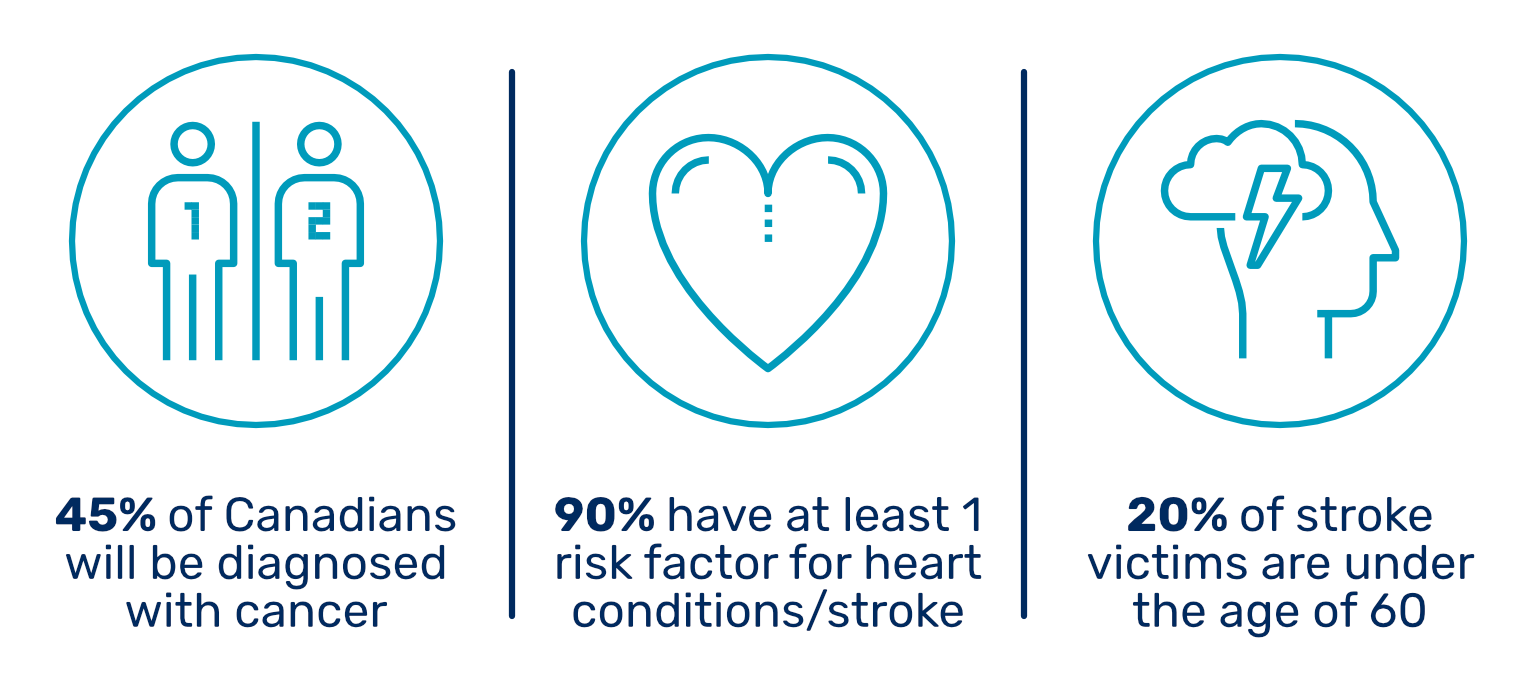

As Canada’s population ages, critical illnesses (CI) like cancer, heart attack, and stroke are becoming increasingly prevalent. Current statistics indicate that 45% of Canadians will be diagnosed with cancer in their lifetime.1 The numbers for heart and brain health paint an even bleaker picture: an alarming 90% of Canadians have at least one risk factor for heart conditions, stroke, or vascular cognitive impairment.2

What is Critical Illness Insurance?

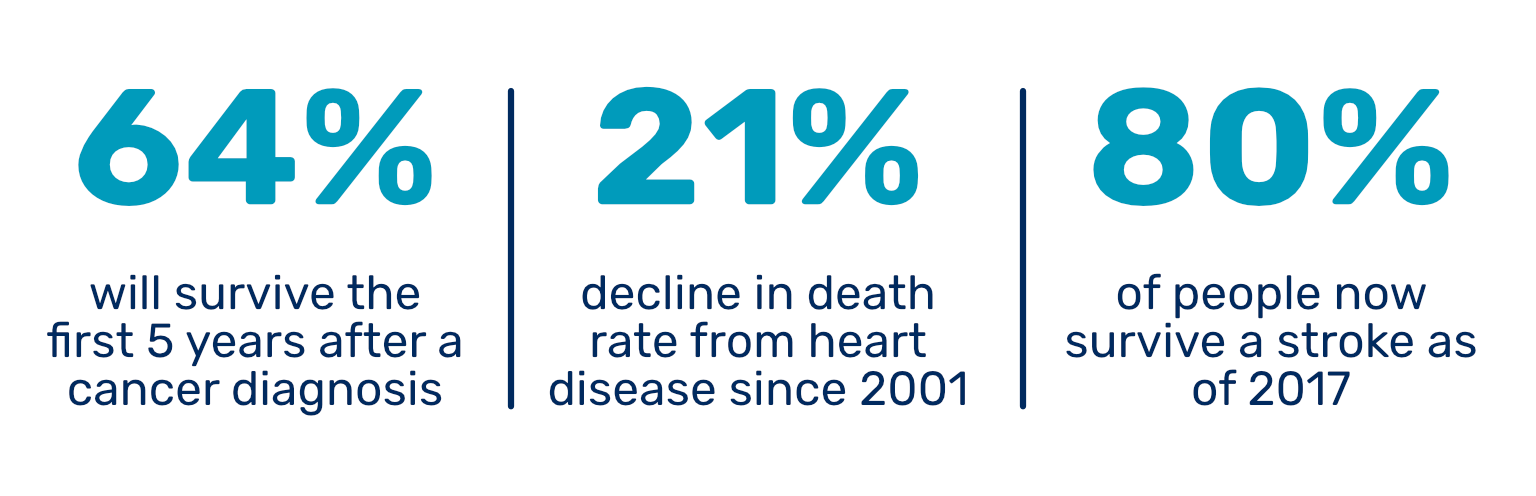

In the early 1980s, South African cardiac surgeon, Marius Barnard, observed that improved medical technology and treatment methods were dramatically increasing the odds of survival for many of his patients diagnosed with a critical illness. His patients, however, were now faced with a new complication: the potentially devastating financial consequences of outliving cancer, heart attack, or stroke.

Barnard then proposed a solution to address the financial burden of a catastrophic health event. With the launch of the first Critical Illness Insurance (CI) policy in 1983, South Africans could obtain coverage for four conditions: heart attack, cancer, stroke, and coronary artery surgery.3

Although revolutionary at the time, Critical Illness Insurance has come a long way since 1983. While the essential purpose and value of CI – providing consumers with added financial protection against medical expenses, loss of income, and other financial burdens during the most traumatic period of their lives and allowing them to focus on their recovery – has remained largely unchanged, the list of covered conditions has dramatically expanded since the 1980s.

Getting benefits should be easy.The EDGE makes it affordable and stress-free.

Get a QuoteWhat does Critical Illness Insurance cover?

Cancer, stroke, and heart attack, sometimes referred to as the ‘Big 3’, present the greatest risk to Canadians4 and have been a mainstay of Critical Illness Insurance policies since their inception. Today, in addition to the ‘Big 3’, some insurers cover over 20 critical conditions, such as:

- Aorta surgery

- Alzheimer’s disease

(including non-Alzheimer’s dementia) - Aplastic anemia

- Bacterial meningitis

- Benign brain tumour

- Blindness

- Cancer

- Cancer recurrence

- Coma

- Coronary artery bypass surgery

- Deafness

- Dismemberment

- Heart attack

- Heart valve replacement

(including heart valve repair) - Loss of independence

- Loss of speech

- Major organ failure

- Major organ transplant

- Motor neuron disease

- Multiple sclerosis

- Occupational HIV infection

- Paralysis

- Parkinson’s disease

- Severe burns

- Stroke

Is Critical Illness Insurance worth it?

Medical technology and critical care has come a long way in the past several decades, but treatment costs remain prohibitively expensive for many Canadians diagnosed with a critical illness, especially when that illness prevents them from working. Whether a critical illness requires expensive treatment or prescription drugs, medical equipment or accommodations, an in-home caregiver, or any other expenses associated with a covered condition, a tax-free, lump-sum Critical Illness Insurance benefit can help you and your family navigate through a difficult period in your lives while protecting your financial future.

How to find the best Critical Illness Insurance in Canada

It’s crucial to understand that not all Critical Illness Insurance plans are identical. One of the primary hurdles Canadians encounter when seeking coverage is the extensive personal and family health history questionnaires required by most Critical Illness Insurance carriers. The underwriting process can be invasive and time consuming, leaving consumers frustrated and potentially without coverage.

Underwriters carefully weigh your responses, often declining applicants who present too great a risk, or accepting the applicant but excluding certain conditions and sometimes even charging higher rates for assuming this risk. Additionally, many insurers may even decline your application outright if you’ve previously applied for and have been declined coverage elsewhere.

For some Canadians, such as those who are looking for a nominal amount of protection, going through the underwriting process hardly seems worth it. Others may not realize that they still have affordable options, regardless of their medical history. If you find yourself in this position, there are still viable options to protect yourself and your family against a catastrophic health event, without the hassle of underwriting and without breaking the bank.

Some Critical Illness Insurance providers, such as The Edge Benefits, offer what is referred to as guaranteed-issue Critical Illness Insurance, which allows you to apply for and receive coverage with no medical questions asked. This option can provide up to $75,000 guaranteed Critical Illness coverage!

A select group of Canadian insurance carriers also provide additional Critical Illness Insurance coverage above and beyond their maximum guaranteed issue amount through a simplified qualification process which involves little more than the completion of a brief series of pre-qualifying questions, and no underwriting. This allows people to purchase up to $125,000 of affordable Critical Illness Insurance without underwriting.

When weighing your options for Critical Illness Insurance, be sure to read the policy’s fine print. In addition to exclusions and limitations, traditional insurers typically terminate the policy once you’ve filed a claim. However, some providers, like The Edge Benefits, offer a built-in second event benefit that allows you to make a claim for a second, unrelated critical condition even if you’ve already received prior compensation under the policy.

But how much Critical Illness Insurance do you need?

Some modern cancer medications can run as much as $7,000 per month.5 Other covered conditions, such as paralysis or stroke, may require home or vehicle modifications to improve one’s quality of life. Just like in Dr. Barnard’s day, most Canadians today are not adequately prepared to bear the potential financial burdens of a critical illness diagnosis. Any amount of Critical Illness protection – even just $75,000 of guaranteed-issue CI coverage – could allow you to pay for the treatment and care you need without exhausting the savings you’ve worked so hard to accumulate.

If you’d like to find out how much coverage you can qualify for, or if you’d like to receive a free quote for the best Critical Illness Insurance in Canada, click the link below or contact and EDGE advisor near you.

Contact The EDGE today toget a quote for Critical Illness Insurance

Get a QuoteSources

1. Canadian Cancer Society

2. Heart and Stroke Foundation of Canada

3. Actuarial Post

4. Statistics Canada

5. Canadian Broadcasting Corporation